Accounts payable is a cost incurred by your seller and as a buyer, you owe a share of this cost to the seller.

What is Accounts Payable?

A Seller may incur an expense during the month, for example, collateral protection insurance for a loan or several loans. When this occurs, as the loan(s) has been participated, the cost is then passed onto the buyers. LoanStreet accounts for these cash outlays in the Accounts Payable section of the monthly Buy Side reports.

Accounts Payable is tracked for each loan so the cost is not offset against the proceeds from other loans, but the borrower's payments as they are received in future months.

Any loans which incur Accounts Payable in one month will have proceeds deducted to pay this share in the following month(s). The Accounts Payable tab on the distribution report tracks the fluctuation from month to month by noting a beginning and ending Accounts Payable balance, as well as any increase or decrease within the reporting period. When the seller receives payments from its borrowers, the buyers' payments are reduced by the Accounts Payable amount. This process best complies with NCUA regulations on loan participations.

Accounts Payable is noted on the Portfolio and Distribution Reports.

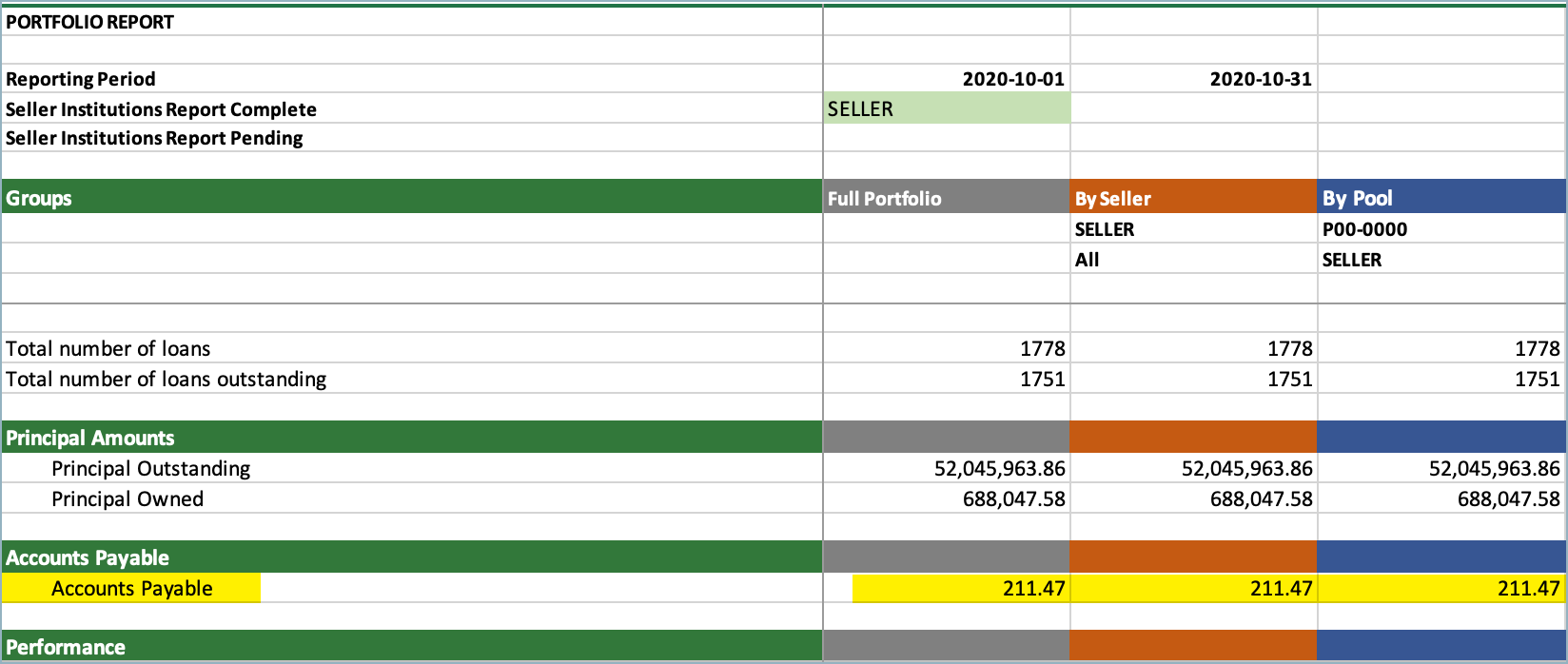

Accounts Payable on the Portfolio Report

The Accounts Payable balance can be found under the Accounts Payable subheading on the Summary tab of the Portfolio Report. This balance is the closing balance of Accounts Payable as of the end of the reporting period.

As with each section in the reports, Accounts Payable can be viewed by the full portfolio in aggregate (gray), portfolio per seller (orange), and portfolio per pool (blue) amounts.

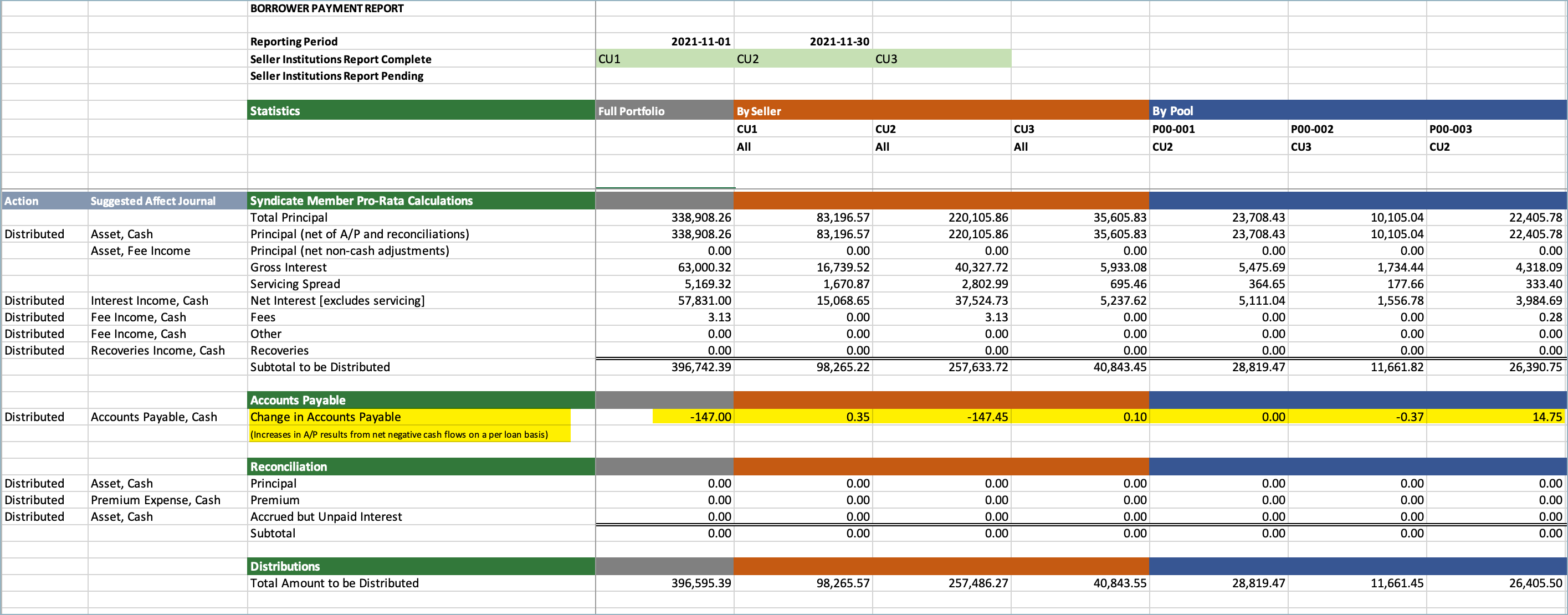

Accounts Payable on the Distribution Report

The Distribution report provides more in-depth detail of the Accounts Payable balance. Under the Summary tab, there is a subheading labeled Changes in Accounts Payable. This is the total of the movement (up or down) since the prior month. This may impact the remittance amount as Accounts Payable is repaid.

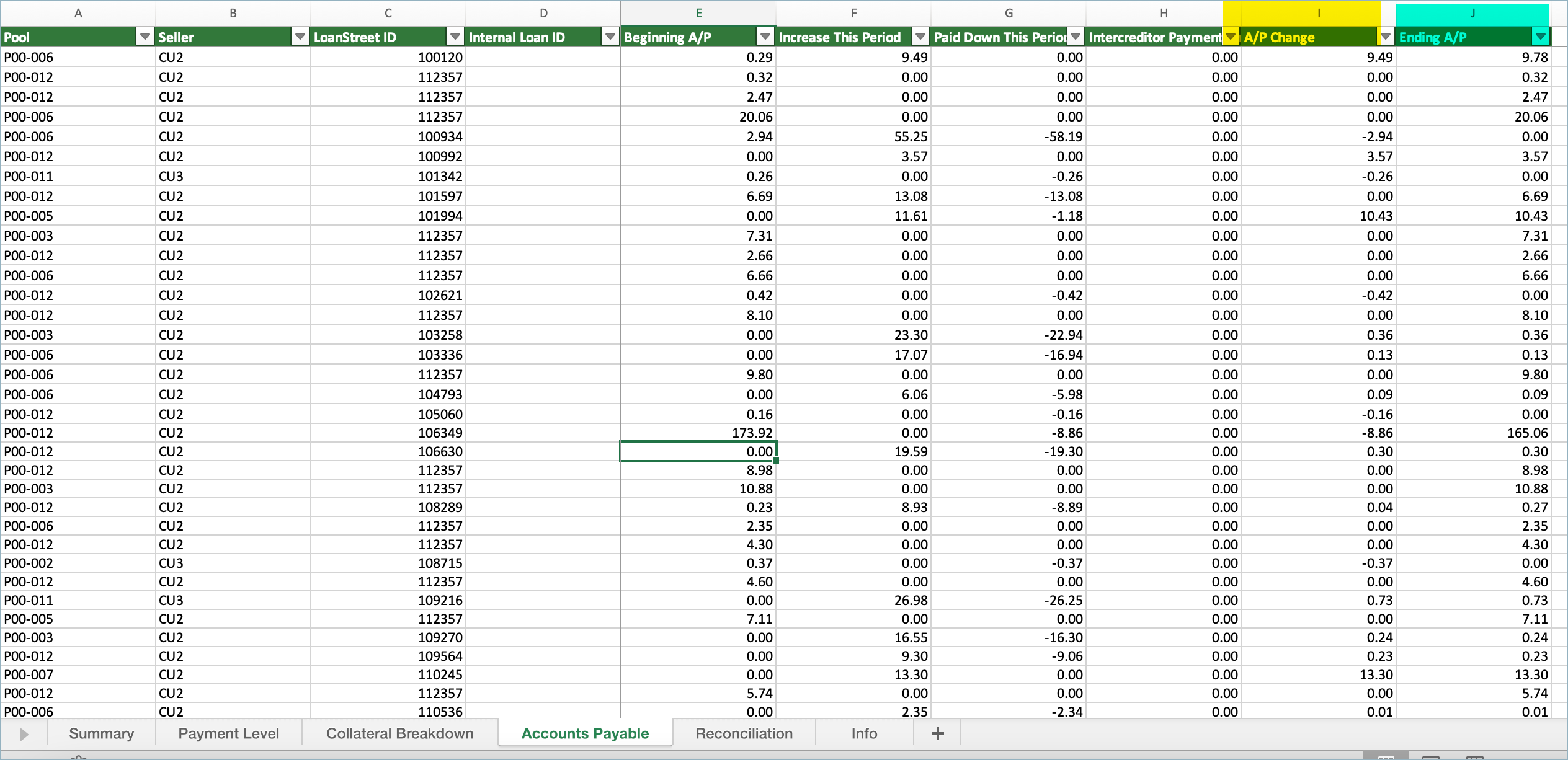

For more detail on a loan-by-loan basis, navigate to the Accounts Payable tab to find a breakdown of the loans that contribute to the amount displayed on the Summary Tab. The balance of column I is the balance of the A/P Change on the Summary tab. The balance of column J is the period ending balance of the AP by loan and the total of this amount is shown on the Portfolio Report.

Use the filters included in the report to review Accounts Payable by loan, pool, or seller.

For further questions, please contact customer support.

LoanStreet 2023